Posts Tagged ‘women owned business’

2024 Executive Networking Conference (ENC)

The Executive Networking Conference has established itself as the premier networking event for minority business executives, corporate decision-makers, bankers and community development leaders for over three decades. Our theme this…

Read MoreDisaster Recovery Workshop

Join the N.C. Department of Transportation Office of Civil Rights for a DISASTER RECOVERY WORKSHOP Tuesday, January 30 10:00 a.m. – Noon NCDOT Division 5 Traffic Services 1041 Prison Camp…

Read MoreTanzanian Economic Development Summit

We are excited to announce an executive-led summit bringing together key government and business leaders from the U.S. and Tanzania. Why Should Your Company Join? The summit will allow interested…

Read MoreEnhance & Protect a Key Business Asset: Register Your Trademarks!

How many forms of intellectual property are important to your business success? Are you producing blogs? Did you spend time and money developing a logo or a slogan? Intellectual property…

Read More2022 Annual Professional Development Conference

Better Business Resource Fair!

Our Best Resource Fair Ever! Nash and Edgecombe County Businesses Mark Your Calendar. We’re bringing you the business resources you need to start or scale your business. It’s like a…

Read MoreImpact of Inflation on Families & MWBEs

The Research, Policy, & Impact Center polled constituents to better understand how inflation is impacting them. Disparities are clear as 72% of minority respondents indicated that their families are experiencing…

Read MoreHow were minority and women owned small businesses assisted by the National Institute of Minority Economic Development during the pandemic?

In a poll conducted by the Research, Policy, & Impact Center, RETOOLNC grant recipients were asked how they used funds they received during the pandemic.

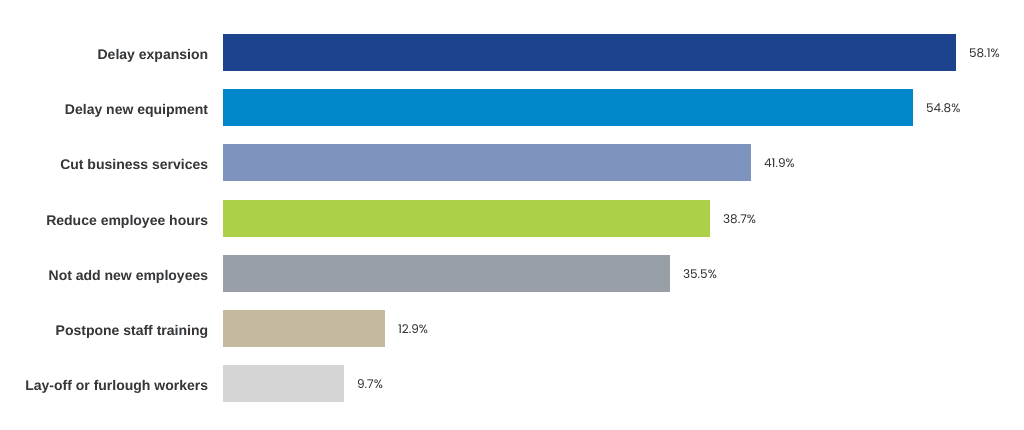

Read MorePoll Shows Rate Increase Adds Additional Financial Burden on Women and Minority Owned Small Business

Last Wednesday (5/3/22), the Federal Reserve raised interest rates by a half percentage point, the largest rate increase since 2000. The Fed previously raised its rate a quarter percentage point…

Read More