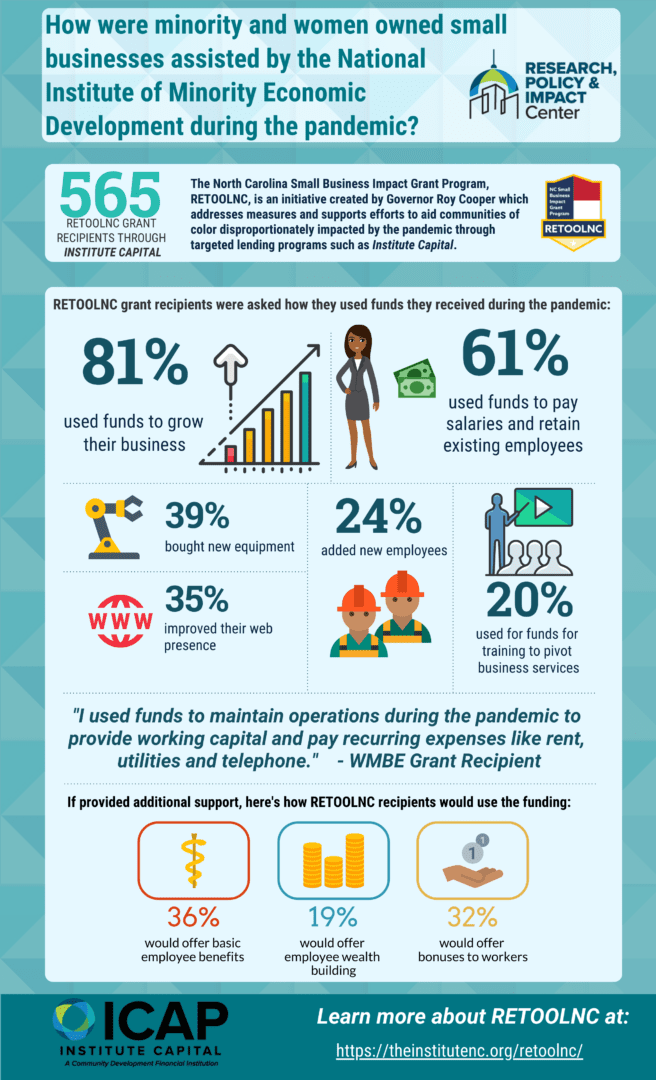

How were minority and women owned small businesses assisted by the National Institute of Minority Economic Development during the pandemic?

The North Carolina Small Business Impact Grant Program, RETOOLNC, is an initiative created by Governor Roy Cooper which addresses measures and supports efforts to aid communities of color disproportionately impacted by the pandemic through targeted lending programs such as Institute Capital.

In a poll conducted by the Research, Policy, & Impact Center, RETOOLNC grant recipients were asked how they used funds they received during the pandemic. A total of 565 emails were sent to 2020/2021 RETOOLNC recipients, 143 surveys were completed for a final response rate of 25.9% (omitting incorrect email addresses). The majority of respondents to this survey represented small businesses with only 1-5 employees (67.6%) or sole proprietor businesses (14.1%). Most (81.4%) were minority owned and half (53.1%) were woman-owned.

Three-fifths (60.6%) of RetoolNC grant recipients who responded to our survey indicated that they used the funds to pay salaries and retain existing employees during the pandemic. 80.7% indicated that they used funds to grow their business. This included: adding employees (23.6%), buying new equipment (39.3%), improving web presence (35.0%), and ‘other’ upgrades (7.9%). Another fifth (20.4%) of respondents said that funds were used for training purposes to pivot business services. Finally, just 2.1% said they used the funding to provide incentives to employees. Other uses included:

- Used funds to hire office 365 Cybersecurity professional.

- Print marketing, online marketing targeted towards brides, an email marketing course, social media ads and boosted social posts

- Invested in promotion of my company to attract new business for the business lost during the pandemic through promotional products, mailings, other contacts and introductions and rewards. Also used these methods to try and retain the current client base.

- I used to repair trucks

- I used funds to maintain operations during the pandemic to provide working capital and pay recurring expenses like rent, utilities and telephone.

- I used funds to enroll in new courses and classes as well as pay down some debt.

- I invested in training and education to expand our business.

- I franchised my company.

- Contractors were added to help further business growth and systems were put in place to attain process efficiency.

The infographic below summarizes some of the other results of this survey: