Impact of Inflation on Families & MWBEs

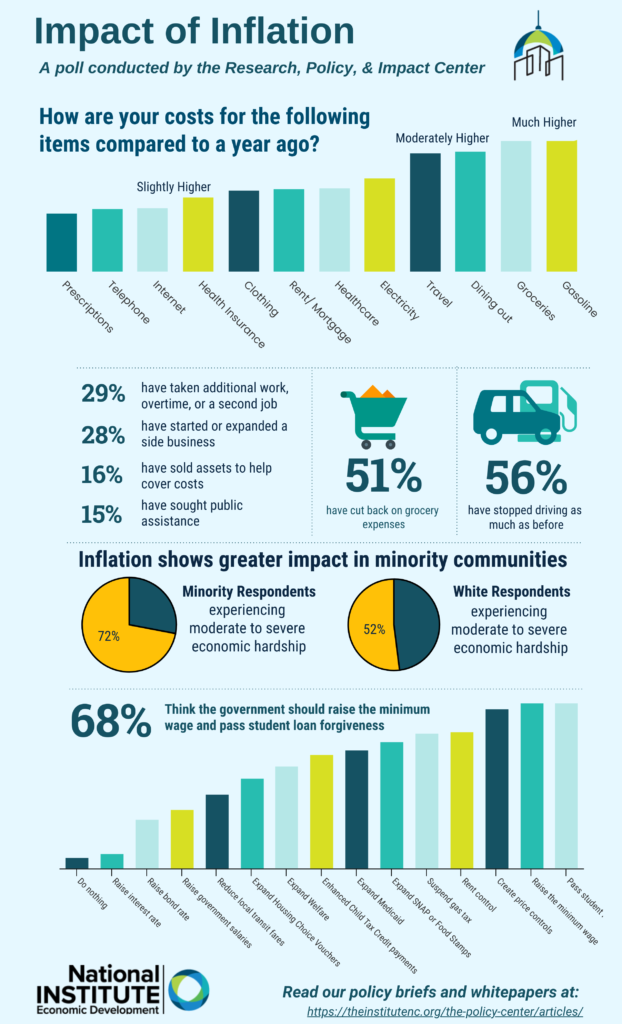

The Research, Policy, & Impact Center polled constituents to better understand how inflation is impacting them. Disparities are clear as 72% of minority respondents indicated that their families are experiencing moderate to severe economic hardship as compared with only 52% of white respondents. Respondents are looking to the federal government to forgive student loan debt, raise minimum wage, institute price controls on fuel and other goods, and expand economic assistance programs.

See results to the poll in the infographic below.

Minority and Women Owned Enterprises indicated that inflation has impacted their ability to make a profit:

- Imported products and shipping costs have increased. NC HUB Certified Business Expansion plans have been slow.

- The cost of fuel and raw materials has certainly impacted project costs and internal operational expenses.

- We’re experiencing delays and loss of customers because they can no longer afford the extra expense.

- We have cash flow issues as staffing costs are much higher than before.

- We are making less profit to accommodate costs.

- We are basically paying to work. With the increase of all mentioned above & the past mentioned. Due to the issues at hand, I fear that there is definitely going to be a domino effect. The worst is yet to come.

- Very little. I am consultant and sole proprietor working from home.

- Unable to operate at a full profit.

- The surge in fuel pricing for diesel is high in NC alone it’s at almost $6 per gallon,. driving trucks places us back into a pandemic, because over the road is the only way you can make money to survive, and other states are higher. While everyone else is slowly recovering from the pandemic, the transportation Industry and the restaurant industry is about to experience another pandemic, due to the inflation of fuel to deliver the goods and the influx in food prices that restaurants and grocery stores have to raise because they are being charged more and need to be able to pay their bills to keep a business

- The costs of supplies, fuel, and employees has increased, decreasing my profit significantly.

- The cost in fuel has directly impacted my services because I have to travel back and forth to client sites. I am not able to take in as many clients without having to pass some of the travel cost to a client to off-set it. I also have to go up on the price of my services due to rise in goods and materials that I use to complete the services provided to the client.

- Supplies are more expensive and transport to and from events is higher

- Significantly. Which has caused a price increase in my products and offering less options, due to increase in product supplies

- Significantly. I own a Trucking Business and the Fuel prices have caused me to take lesser paying loads for shorter distances.

- Shipping cost is higher.

- Severely

- Seriously contemplating whether or not this will be the last year of business and if its time to close our doors. Still recovering from the effects of COVID on a small business with inflation and cost on the rise is what will cripple us.

- Purchasing materials is more expensive. I have switched to consulting more.

- Not directly because we work from home and do data analytics – no inventory and very low overhead costs except for travel.

- My photography business been wiped out by COVID protocols.

- my business is home-based, and I also work a full-time job. My business supports small business owners and non-profit organizations so I have seen a reduction in business because they cannot afford my services, and many have reduced their businesses.

- Most of what I do is remote. My business cost has remained the same. The financial hit is more on a personal level. I know I have to generate more business to plan for any potential losses in the future and take as much work as possible. I have expanded my workday and work weekends in order to try to adapt to the economic changes and the potential of losing clients.

- More meetings are held via Zoom or Facetime

- Man-made electromagnetic fields (as mentioned in my previous statement in this survey) is what is destroying my business and life. I am about to join a two-hour support group for folks suffering from this right now, that is hosted by the Electrosensitive Society of Canada. But yes…lower income with these higher costs in general – along with the EMF take over – have become a disaster for me.

- Lower profit

- Losing customers, expenses are high so making less money

- Less traveling for business development and networking opportunities. Fewer company-sponsored meals for the team. Searching for opportunities for efficiencies in services.

- Less money for business

- I’ve stopped the delivery service

- It’s hard to see a profit and when we increase prices to keep up with inflation we loose customers

- It’s caused us to maintain our business with our personal income. It’s draining us but we are prayerful

- It would be extremely detrimental if we did not have a healthy cash reserve. Some increases we’re able to pass on to clients. most of our biz expenses have remained stable, and others we’ve absorbed since there haven’t been too many to where it’s unbearable

- It slowed down my business because people can’t afford my services and I’m mobile

- It has impacted my business negatively. I have to pass any increases on to my customers which isn’t sitting well with them. I have to increase my pricing on bid projects to cover gas/travel and increased per diem for out of town overnight stays, not to mention the increase in costs of equipment from manufacturers. Lastly, supply chain issues have me waiting months to get equipment and in some cases up to a year. I can’t close out jobs or increase revenue if I can’t get equipment!

- It has impacted it tremendously especially the gas prices

- It has effect my business tremendously because we travel to clean medical facilities. The gas is extremely high. So I try to give the staff a little extra for gas. Which in terms it is costing me more to run the business. Money that I don’t have. I had to apply for a line of credit to really make ends meet.

- Increased operational expenses all the way around

- Income is not rising to meet the rising cost of expenses this is lowering my disposable income tremendously

- I’m definitely being impacted the gas to meet clients, the food expense if I’m meeting at a restaurant. The amount for supplies increased.

- I’m a personal trainer so for most people my services are not a necessity. People are spending more on just surviving, and they don’t seek out my services.

- I spend over 2500 a week in fuel to run my business which is extremely costly

- I provide professional services (consulting), so I haven’t noticed much of an impact. I cannot say if less businesses are soliciting professional services though.

- I buy less inventory and supplies, and at a slower rate.

- I am at a stand still..

- I am a mobile dog groomer so higher gas prices have really set me back.

- Huge impact and funding has been disappointing

- Higher shipping cost

- Harder for employees

- Greatly! I have nearly doubled prices due to the costs of food, gas, materials and employee costs.

- Goods and services have increased drastically not just due to inflation but the increase was seen due to COVID. The cost of dental supplies sky-rocketed and the wages of employees increase drastically as well.

- Gas has taken away all of the profits for my hauling company. Making it difficult to operate and pay adequate wages.

- Gas has been a big impact, since we have to drive our child to school. Supply chain delays have impacted car and house repairs.

- Fuel cost often are half if not more than the days earnings which doesn’t leave much for saving or pay incentives for employees. Maintenance cost have went up and the quality has gone down.

- Fuel and supplies have gone up dramatically.

- Everything costs much more

- Despite the COVID numbers dropping, we still network via online meeting apps. This is not optimal but gas is too expensive to drive around for onsite networking. I am also more reluctant to outsource functions that can be done in-house (though with a lot of effort) because the cost of services has increased along with everything else.

- COVID had my business shut down for a year. The rent for the commercial space has increased twice and not it is at the point I can not afford to keep my doors open after 30 years being in business. It is so overwhelming just to keep the lights on and now higher rent – it is too much. Lay offs and now closings

- As mentioned, before I feel that I am all over the place trying to stay above water living check to check. We started a transportation business to help us get ahead, but it is taxing us we are spending almost 3K to 4K a month depending on the situation with just 1 vehicle this is unheard of. This does not include maintenance fees for the vehicle wear and tear and upkeep required just this past month we spent $3500. We thought starting this during COVID will allow us to save towards purchasing a home, but at the same time our rent has increase $200 more than what we initially signed up for not including the other maintenance fees. We feel trapped paying almost $1800 a month in a 2-bedroom apartment. Always having to make payment arrangements it’s nuts. We have no healthy live, work, play, learn, eat balance at all.

- As a trucking company sky rocketing fuel prices has impacted the companies overall profitability

- About 10k more a month

- Increased prices for inventory.