Posts Tagged ‘Policy Agenda’

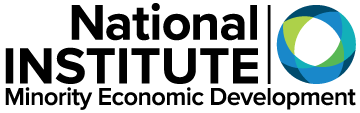

RPIC Policy Agenda – Increase Affordable, Fair, & Healthy Housing Options

Rather than narrowing, the gap in homeownership rates by race has grown steadily over the last century. In 1900, the gap between white and Black homeownership was 27.6%, that gap has not improved in the last 121 years with U.S. Census Bureau data from April 2021 showing a 29.6% difference between white and Black homeowners. The relationship between income, housing, and wealth accumulation is interconnected.

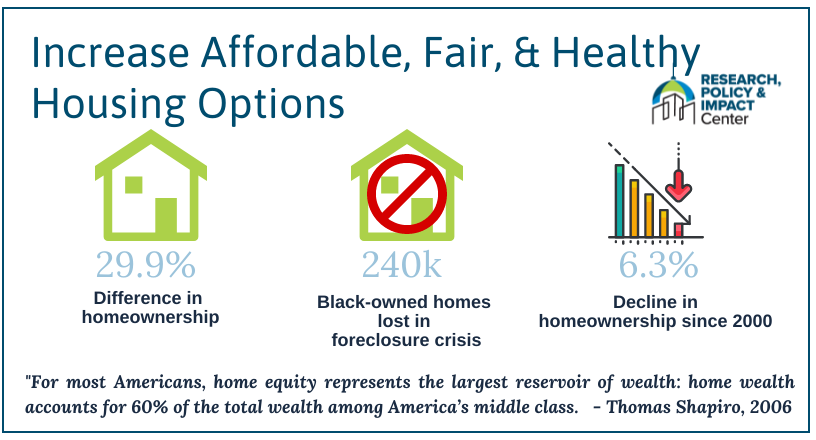

Read MoreRPIC Policy Agenda – Advancing Economic Opportunities for Minority Communities

The wage and wealth gap between white and Black workers is an important contributor to disparities in access to quality housing, medical care, food access, and educational opportunities.

Read More